The Complete Guide to Compound Interest Savings: Transform Your Financial Future Through Strategic Wealth Building

Share

In today's financial landscape, building wealth through compound interest savings remains one of the most powerful strategies for long-term financial success. Understanding how compound interest works and implementing effective savings strategies can dramatically transform your financial future, turning modest monthly contributions into substantial wealth over time.

Understanding Compound Interest: The Foundation of Wealth Building

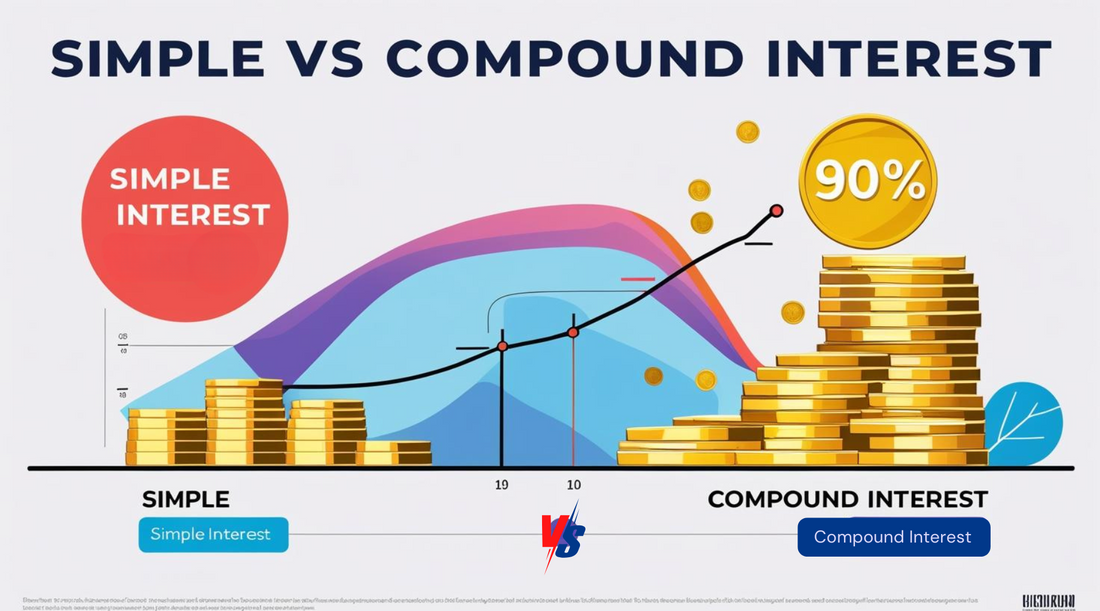

Compound interest is often called "the eighth wonder of the world" because of its remarkable ability to multiply your money exponentially over time. Unlike simple interest, which only earns returns on your initial principal, compound interest generates returns on both your original investment and all previously earned interest.

The mathematical beauty of compound interest lies in its exponential growth pattern. Compound interest, or "interest on interest", is calculated using the formula A = P(1 + r/n)nt, where P is the principal balance, r is the annual interest rate (as a decimal), n is the number of times interest is compounded per year, and t is the number of years.

Real-World Compound Interest Examples

Consider this powerful example: Let's say you start saving $100 a month at age 20. You earn an average annual interest rate of 4%, compounded monthly, over 40 years. You earn $151,550 by age 65. Your principal investment was $54,100. This means compound interest generated over $97,000 in additional wealth simply by starting early.

To illustrate the time value of money, imagine your twin who waits until age 50 to start investing. Even with the same monthly contribution and interest rate, they would need to save significantly more to achieve similar results, demonstrating why time is your greatest ally in compound interest savings.

Benefits of Compound Interest for Long-Term Financial Growth

Passive Wealth Accumulation

The primary advantage of compound interest savings is the passive nature of wealth accumulation. Once you establish a systematic savings routine, your money works continuously to generate returns without requiring active management or additional effort from you.

Inflation Protection Through Compound Growth

With current interest rates offering attractive returns, compound interest savings can help protect your purchasing power against inflation. The best high-yield savings account rate is 5.00% APY. That's more than 13 times the FDIC's national average for savings accounts of 0.38% APY.

Risk Mitigation Through Diversified Savings Strategies

Compound interest savings offer an excellent balance between growth potential and risk management. Unlike volatile investment options, savings accounts with compound interest provide predictable returns while maintaining liquidity and FDIC protection.

[Image: Risk-return spectrum chart showing various investment options from savings accounts to stocks, highlighting the sweet spot of compound interest savings]

High-Yield Savings Accounts: Maximizing Your Compound Interest Potential

Choosing the Right High-Yield Savings Account

When selecting a high-yield savings account for compound interest growth, consider these critical factors:

Interest Rate Competitiveness: Look for accounts offering rates significantly above the national average. Current market leaders provide APYs that can substantially accelerate your compound interest earnings.

Compounding Frequency: Savings accounts that compound daily, as opposed to weekly or monthly, are the best because frequently compounding interest increases your account balance faster. Daily compounding means your interest earns interest every single day, maximizing the compounding effect.

Account Accessibility and Features: Ensure your chosen account offers convenient online access, mobile banking capabilities, and reasonable withdrawal limits without sacrificing interest rates.

Digital Banking Advantages for Compound Interest Savings

In 2025, with interest rates rebounding from their lows and fintech platforms competing for your deposits, savers now have more ways than ever to harness the power of compounding—daily, monthly, or even minute-by-minute in some cases. Digital banking platforms often provide superior interest rates and innovative features that traditional banks cannot match.

[Image: Comparison table of top 10 high-yield savings accounts with APY rates, compounding frequency, and key features]

Practical Compound Interest Calculation Methods

The Compound Interest Formula in Action

Understanding how to calculate compound interest empowers you to make informed financial decisions and project your savings growth accurately. For example, if you want to calculate monthly compound interest, simply divide the annual interest rate by 12 (the number of months in a year), add 1, and raise the result to the power of 12 * t (years).

Step-by-Step Calculation Examples

Scenario 1: Monthly Contributions with Annual Compounding

- Principal: $10,000

- Monthly Addition: $500

- Annual Interest Rate: 4.5%

- Time Period: 15 years

- Result: Demonstrates how consistent contributions amplify compound interest effects

Scenario 2: Lump Sum with Daily Compounding

- Initial Investment: $25,000

- Annual Interest Rate: 5.2%

- Daily Compounding

- Time Period: 20 years

- Result: Shows pure compound interest growth without additional contributions

Strategic Savings Approaches for Maximum Compound Interest Benefits

The 50/30/20 Rule for Compound Interest Savings

Following the 50/30/20 rule (50% needs, 30% wants, 20% savings) is a practical method. For instance, allocating ₹10,000 monthly to a high-yield compounding investment can help you achieve long-term goals like buying a house or funding a child's education.

Automated Savings Strategies

Automation removes the emotional and behavioral barriers to consistent saving. Set up automatic transfers to your high-yield savings account immediately after each paycheck. This "pay yourself first" approach ensures you consistently contribute to your compound interest savings before discretionary spending temptations arise.

Dollar-Cost Averaging for Savings

While typically associated with investing, dollar-cost averaging principles apply to compound interest savings. Regular, consistent contributions smooth out the effects of interest rate fluctuations and create a disciplined savings habit that maximizes compounding benefits.

Advanced Compound Interest Strategies

Laddering Certificates of Deposit

If you're a beginning investor and want to start taking advantage of compound interest right away with little risk, savings vehicles such as CDs and savings accounts are the way to go. CDs require a minimum deposit and pay you interest at regular intervals, typically at a higher interest rate than traditional savings accounts.

CD laddering involves purchasing multiple certificates of deposit with staggered maturity dates, allowing you to benefit from compound interest while maintaining liquidity and taking advantage of potentially higher rates.

Money Market Account Optimization

Money market accounts: These are almost the same as savings accounts, but often provide check-writing privileges and debit card access while maintaining competitive interest rates. They offer an excellent middle ground between savings accounts and checking accounts for compound interest growth.

Tax-Advantaged Compound Interest Savings

Consider maximizing compound interest within tax-advantaged accounts like IRAs or 401(k)s. The money can add up: If you kept the funds in a retirement account for over 30 years and earned that 6% average return, for example, your $10,000 would grow to more than $57,000.

Common Mistakes in Compound Interest Savings

Procrastination: The Greatest Enemy of Compound Interest

The most significant mistake individuals make is delaying their savings journey. Every month you postpone starting reduces the total compound interest you'll earn over your lifetime. The power of compound interest is directly proportional to time, making early action crucial.

Inconsistent Contribution Patterns

Sporadic savings contributions significantly diminish compound interest benefits. Consistency trumps large, infrequent deposits because regular contributions ensure continuous compounding and develop sustainable financial habits.

Overlooking Compounding Frequency

Many savers focus solely on interest rates while ignoring compounding frequency. An account with a slightly lower APY but daily compounding might outperform one with a higher rate but annual compounding over extended periods.

Premature Withdrawals

Frequent withdrawals interrupt the compound interest process and can result in penalties or lost interest. Maintain separate emergency funds to avoid disrupting your compound interest savings growth.

Technology Tools for Compound Interest Optimization

Compound Interest Calculators and Apps

Modern technology offers sophisticated tools for modeling compound interest scenarios. To take advantage of compound interest over time, maximize both your rate and your savings balance. Consider a high-yield savings account and save more over time, such as with automatic savings transfers or trying the 52-week savings challenge.

Mobile Banking Features for Compound Interest Tracking

Contemporary banking apps provide real-time compound interest tracking, allowing you to monitor your progress and adjust strategies accordingly. Look for apps offering interest projections, savings goal tracking, and automated round-up features.

Financial Planning Software Integration

Integrate your compound interest savings into comprehensive financial planning software to understand how your savings strategy aligns with broader financial goals like retirement planning, home purchases, or education funding.

[Image: Screenshot montage of popular compound interest calculator apps and their key features]

Building Your Compound Interest Savings Plan

Setting Realistic Savings Goals

Establish specific, measurable, achievable, relevant, and time-bound (SMART) savings goals that leverage compound interest effectively. Consider both short-term milestones and long-term wealth-building objectives.

Regular Strategy Review and Adjustment

Schedule quarterly reviews of your compound interest savings strategy. Assess whether your current approach aligns with changing financial circumstances, interest rate environments, and personal goals.

Emergency Fund Integration

Incorporate compound interest savings into your emergency fund strategy. While maintaining liquidity for unexpected expenses, your emergency fund can still benefit from compound interest growth in high-yield savings accounts.

Legacy Planning Through Compound Interest

Consider how compound interest savings can contribute to generational wealth transfer. Starting compound interest savings for children or grandchildren can create substantial financial advantages over their lifetimes.

Conclusion: Your Compound Interest Success Journey

Compound interest savings represent one of the most reliable paths to long-term financial success. By understanding the mathematical principles, implementing strategic savings approaches, and maintaining consistent contributions, you can harness the exponential power of compound interest to achieve your financial goals.

The key to compound interest success lies in starting early, staying consistent, and choosing the right savings vehicles for your specific circumstances. Whether you're beginning your financial journey or optimizing an existing strategy, compound interest savings offer a proven method for building substantial wealth over time.

Remember that compound interest rewards patience and consistency above all else. Every dollar saved today becomes the foundation for tomorrow's financial security, growing exponentially through the mathematical magic of compound interest.

Start your compound interest savings journey today, and watch as small, consistent actions compound into life-changing financial results. Your future self will thank you for the financial discipline and strategic thinking you demonstrate today.

More Resources

Three Hard Truths About Success Most Men Avoid (And How to Finally Face Them)

This comprehensive guide provides the foundational knowledge needed to leverage compound interest for your financial success. For personalized advice regarding your specific financial situation, consider consulting with a qualified financial advisor.